In an ever-evolving digital landscape, the need for secure, accessible, and comprehensive financial solutions has never been more crucial. MyLiberla.com, a pioneering online platform, is revolutionizing the way individuals and businesses manage their financial well-being. With its user-friendly interface, intuitive natural language processing capabilities, and a wide range of personalized services, MyLiberla.com has emerged as a trusted financial partner for those seeking to take control of their financial journey.

Key Takeaways

- MyLiberla.com is a comprehensive online financial platform offering secure banking, smart investments, and personalized solutions.

- The platform leverages natural language processing and language understanding to provide a user-friendly experience.

- MyLiberla.com is committed to empowering individuals and businesses to achieve their financial goals.

- The platform offers a wide range of services, including personal finance management, investment guidance, and debt management resources.

- MyLiberla.com prioritizes data protection and user privacy, ensuring a secure and trusted financial environment.

What is MyLiberla.com?

MyLiberla.com is a comprehensive online financial platform that caters to the diverse needs of individuals and families. Offering a range of services, this innovative website empowers users to take control of their financial well-being through intuitive tools and personalized guidance.

Overview of Services

At the heart of MyLiberla.com’s offerings is a suite of online banking features that make managing finances effortless. From real-time account monitoring to automated savings plans, the platform provides a seamless user experience. Additionally, MyLiberla.com integrates advanced text analytics, speech recognition, and sentiment analysis capabilities to offer personalized financial recommendations tailored to each user’s unique goals and preferences.

Key Features

MyLiberla.com’s key features include:

- Comprehensive personal finance management tools

- Intuitive investment planning and portfolio tracking

- Innovative debt management solutions

- Seamless integration with external banking and investment accounts

- Customizable spending and savings insights

- Secure and confidential data protection protocols

By leveraging the power of cutting-edge technology, MyLiberla.com empowers users to make informed financial decisions, streamline their daily money management tasks, and achieve their long-term financial objectives with confidence.

“MyLiberla.com has been a game-changer for my financial planning. The personalized insights and easy-to-use tools have helped me take control of my money and reach my goals faster than I ever thought possible.”

– Sarah Johnson, MyLiberla.com user

Benefits of Using MyLiberla.com

Navigating the world of personal finance can be daunting, but MyLiberla.com offers a suite of cost-effective solutions that make managing your money a breeze. From accessible financial resources to a user-friendly interface, this online platform empowers individuals to take control of their financial well-being.

Cost-Effective Solutions

Compared to traditional banking services, MyLiberla.com provides a more affordable alternative, with lower fees and reduced overhead costs. By leveraging the power of chatbots, machine translation, and computational linguistics, the platform streamlines financial transactions and offers personalized guidance, without the hefty price tag often associated with in-person advisory services.

Accessible Financial Resources

- MyLiberla.com’s comprehensive library of educational resources helps users navigate complex financial concepts, from budgeting and investing to debt management and retirement planning.

- The platform’s 24/7 accessibility ensures that individuals can access the tools and information they need, whenever and wherever they need it, empowering them to make informed financial decisions.

User-Friendly Interface

Designed with the user in mind, MyLiberla.com’s intuitive interface makes managing your finances a seamless experience. The platform’s clean layout and intuitive navigation allow users of all technical abilities to easily access and utilize the available features, fostering a sense of financial confidence and control.

“MyLiberla.com has been a game-changer for my financial well-being. The cost-effective solutions and accessible resources have helped me take control of my money and achieve my financial goals.”

By leveraging the power of innovative technologies, MyLiberla.com offers a comprehensive and user-friendly solution for individuals seeking to improve their financial well-being. With cost-effective services, accessible resources, and an intuitive interface, this online platform empowers users to navigate their financial journey with confidence and ease.

How to Get Started with MyLiberla.com

Jumpstarting your financial journey with MyLiberla.com is a seamless process that empowers you to take control of your money. Whether you’re a seasoned investor or just starting to explore the world of personal finance, the platform’s intuitive interface and comprehensive tools make it easy to navigate your financial landscape.

Creating an Account

Signing up with MyLiberla.com is a straightforward affair. Simply visit the website, click on the “Get Started” button, and follow the guided steps to set up your account. The platform will prompt you to provide basic personal and financial information, ensuring a secure and personalized experience from the outset.

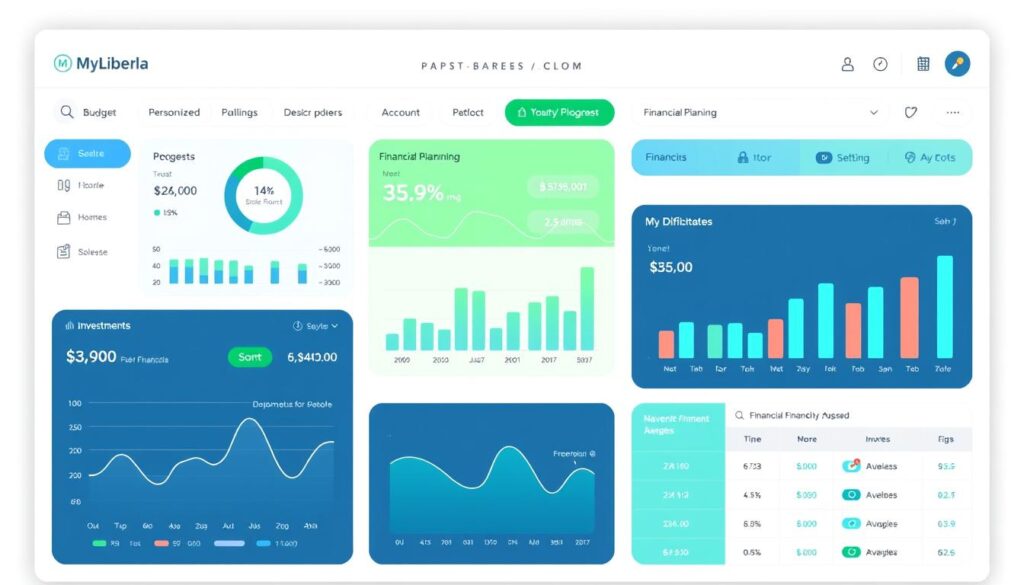

Navigating the Dashboard

Once your account is established, you’ll be greeted by MyLiberla.com’s intuitive dashboard. This centralized hub gives you instant access to a wealth of features, seamlessly integrating language models and natural language processing to deliver a user-friendly experience. From here, you can manage your budgets, track investments, and explore a range of financial tools tailored to your specific needs.

| Feature | Description |

|---|---|

| Spending Tracker | Monitor your daily, weekly, and monthly spending habits with ease. |

| Investment Portfolio | Gain a comprehensive view of your investment holdings and track their performance. |

| Debt Management | Develop a personalized plan to pay off outstanding debts and improve your financial health. |

The intuitive design and seamless integration of language models and natural language processing make navigating the MyLiberla.com dashboard a breeze, empowering you to stay on top of your financial goals with confidence.

Services Offered by MyLiberla.com

MyLiberla.com is a comprehensive financial platform that provides a wide range of services to cater to the diverse needs of its users. From personal finance management to investment guidance and debt management resources, the website offers a holistic approach to individuals’ financial well-being.

Personal Finance Management

At the heart of MyLiberla.com’s offerings is its robust personal finance management tools. Users can leverage the platform’s budgeting features, which utilize language understanding and text analytics to help them gain a deeper understanding of their spending habits and create customized budgets. The platform also provides expense tracking, goal-setting, and bill payment features, empowering users to take control of their financial lives.

Investment Guidance

MyLiberla.com’s investment guidance services offer users a tailored approach to managing their financial portfolios. The platform’s team of experienced financial advisors provides personalized recommendations based on the user’s risk profile, investment goals, and market conditions. With features like portfolio analysis, asset allocation, and performance tracking, users can make informed decisions and optimize their investment strategies.

Debt Management Resources

Recognizing the importance of effective debt management, MyLiberla.com offers a suite of resources to help users navigate their debt-related challenges. The platform provides guidance on debt consolidation, negotiation with creditors, and the development of personalized repayment plans. Additionally, users can access educational materials and tools to better understand the principles of language understanding and text analytics in the context of their financial obligations.

| Service | Key Features | Benefits |

|---|---|---|

| Personal Finance Management |

|

|

| Investment Guidance |

|

|

| Debt Management Resources |

|

|

Security Measures at MyLiberla.com

MyLiberla.com takes the security and privacy of its users’ data extremely seriously. The platform employs robust data protection protocols and user-centric privacy policies to safeguard sensitive financial information and personal details.

Data Protection Protocols

MyLiberla.com utilizes advanced encryption technologies to secure all user data transmitted through the platform. This includes the use of speech recognition and sentiment analysis tools to enhance the security of online transactions and communications. Additionally, the platform implements multi-factor authentication measures to verify user identities, providing an extra layer of protection against unauthorized access.

User Privacy Policies

The privacy of MyLiberla.com users is of paramount importance. The platform’s comprehensive privacy policies outline strict guidelines for the collection, storage, and usage of personal information. Users have full control over their data, with options to review, update, and even delete their information as needed. MyLiberla.com also adheres to industry-standard data retention and disposal practices to ensure the confidentiality of user records.

| Security Feature | Description |

|---|---|

| Encryption | Advanced encryption protocols to secure user data |

| Multi-Factor Authentication | Additional verification measures to protect user accounts |

| Privacy Policies | Comprehensive guidelines for data collection, storage, and usage |

“At MyLiberla.com, we are committed to ensuring the highest levels of security and privacy for our users. Our advanced data protection protocols and user-centric policies are designed to safeguard your financial information and personal details.”

Customer Support at MyLiberla.com

At MyLiberla.com, we understand that reliable customer support is essential for our users. That’s why we’ve established a comprehensive customer support system to ensure your financial journey with us is seamless and stress-free.

Contact Methods

Our team of knowledgeable and dedicated support specialists is available through multiple channels to cater to your needs. You can reach us via:

- Live chat: Instantly connect with our representatives for real-time assistance.

- Email: Send your inquiries to our support team, and we’ll respond promptly.

- Phone: Speak directly with a customer service representative for personalized support.

FAQs and Resources

In addition to our direct support channels, we’ve curated a comprehensive FAQ section and a resource library to help you find answers to your questions. Our user-friendly interface and intuitive navigation make it easy to access the information you need, whether you’re using a desktop or a mobile device.

For users who prefer a more interactive learning experience, we offer step-by-step video tutorials and in-depth articles that cover a wide range of topics, from chatbots to machine translation and beyond. Our goal is to empower you with the knowledge and tools you need to make informed financial decisions.

| Support Channel | Response Time | Operating Hours |

|---|---|---|

| Live Chat | Immediate | 7 days a week, 24 hours a day |

| Within 1 business day | Monday to Friday, 9 AM to 6 PM | |

| Phone | Immediate | Monday to Friday, 9 AM to 6 PM |

At MyLiberla.com, we are committed to providing you with the best possible customer experience. Our dedicated support team is here to assist you every step of the way, ensuring that you can navigate your financial journey with confidence and ease.

“The customer support team at MyLiberla.com has been incredible. They’ve helped me resolve issues quickly and provided valuable insights to improve my financial management.”

Success Stories from MyLiberla.com Users

At MyLiberla.com, we take great pride in the positive impact we have made on our users’ financial well-being. Through our innovative computational linguistics and language models, we have empowered individuals to take control of their financial futures and achieve remarkable results. Let’s explore some inspiring success stories that showcase the transformative power of our platform.

Testimonials

“MyLiberla.com has been a game-changer for me. As a busy professional, I struggled to keep track of my finances, but the platform’s user-friendly interface and personalized recommendations have made managing my money a breeze. I’m now able to save more, pay off debts, and invest with confidence. Thank you, MyLiberla.com, for helping me achieve my financial goals!” – Emily, 35, San Francisco.

“Before discovering MyLiberla.com, I felt overwhelmed and lost when it came to my personal finances. The educational resources and tailored guidance provided by the platform have been invaluable. I’ve learned so much about budgeting, investing, and debt management, and I’m now on a solid path to financial stability. MyLiberla.com has truly transformed my relationship with money.” – Michael, 42, Chicago.

Case Studies

One of our most inspiring success stories comes from Sarah, a 28-year-old recent college graduate living in New York City. Sarah joined MyLiberla.com soon after starting her first job, determined to build a strong financial foundation. Through the platform’s personalized budgeting tools and investment recommendations, Sarah was able to pay off her student loans in just three years and start saving for a down payment on a home. Today, she’s a homeowner and confidently managing her finances, all thanks to the guidance and support of MyLiberla.com.

Another remarkable case study is that of John, a 55-year-old small business owner. Struggling with cash flow and debt management, John turned to MyLiberla.com for help. The platform’s debt consolidation and restructuring tools, combined with its investment strategies, enabled John to streamline his finances, reduce his interest payments, and grow his business. Now, John is enjoying a more secure financial future and is able to focus on expanding his company.

| User | Age | Location | Challenge | MyLiberla.com Solution | Outcome |

|---|---|---|---|---|---|

| Emily | 35 | San Francisco | Struggling to manage finances | User-friendly interface, personalized recommendations | Able to save more, pay off debts, and invest with confidence |

| Michael | 42 | Chicago | Overwhelmed with personal finances | Educational resources, tailored guidance | Achieved financial stability and gained knowledge in budgeting, investing, and debt management |

| Sarah | 28 | New York City | Paying off student loans, saving for a home | Personalized budgeting tools, investment recommendations | Paid off student loans in 3 years, became a homeowner |

| John | 55 | N/A | Cash flow and debt management for small business | Debt consolidation and restructuring tools, investment strategies | Streamlined finances, reduced interest payments, and grew his business |

These success stories are a testament to the power of computational linguistics and language models in transforming financial lives. By leveraging innovative technology and providing personalized guidance, MyLiberla.com has empowered users to take control of their finances and achieve their goals. As we continue to innovate and enhance our platform, we look forward to many more inspiring stories from our valued users.

Comparison with Other Financial Platforms

As the digital landscape continues to evolve, MyLiberla.com has distinguished itself as a premier online financial platform, offering a unique blend of features and user experiences that set it apart from traditional banking services and other fintech competitors. By leveraging the power of natural language processing and advanced language understanding, MyLiberla.com has crafted a seamless and intuitive user experience that caters to the diverse needs of modern consumers.

Unique Selling Points

Unlike many traditional financial institutions, MyLiberla.com prioritizes personalization and customization, empowering users to tailor their financial management experience to their specific goals and preferences. Through its robust suite of natural language processing and language understanding capabilities, the platform provides intelligent financial insights and recommendations that go beyond the one-size-fits-all approach often found in the industry.

User Experience Insights

- Intuitive dashboard with real-time financial tracking and analytics

- Seamless integration of banking, investment, and budgeting tools

- Personalized financial guidance powered by advanced natural language processing and language understanding algorithms

- Responsive and mobile-friendly design for on-the-go financial management

- Comprehensive educational resources and financial literacy content

| Feature | MyLiberla.com | Competitor A | Competitor B |

|---|---|---|---|

| Natural Language Processing | ✓ | ✕ | ✕ |

| Language Understanding | ✓ | ✕ | ✕ |

| Personalized Insights | ✓ | ✕ | ✓ |

| Seamless Integration | ✓ | ✓ | ✕ |

| Mobile Accessibility | ✓ | ✓ | ✓ |

By leveraging the power of natural language processing and language understanding, MyLiberla.com has created a user experience that is both efficient and intuitive, allowing customers to manage their financial affairs with ease and confidence. This innovative approach sets the platform apart from its competitors, positioning it as a trusted, next-generation financial partner for the digital age.

Future Developments at MyLiberla.com

At MyLiberla.com, we’re committed to continually enhancing our platform and providing our users with the most advanced financial tools and resources. As we look to the future, we’re excited to unveil a roadmap of innovative features and expanded services designed to empower our customers on their financial journeys.

Upcoming Features

One of the key focus areas for our team is integrating cutting-edge text analytics and speech recognition capabilities into our platform. These advanced technologies will enable our users to seamlessly interact with their financial data, streamlining tasks such as budget tracking, expense categorization, and investment portfolio management. By harnessing the power of artificial intelligence, we aim to deliver a more intuitive and personalized user experience.

Roadmap for Innovation

Beyond the immediate feature enhancements, our long-term vision for MyLiberla.com includes exploring new avenues for financial education and personalized guidance. We’re committed to leveraging the latest advancements in data science and machine learning to provide our users with tailored insights and recommendations, empowering them to make well-informed decisions about their financial futures. As we continue to evolve, our focus will remain on empowering our community and fostering their success.